- SpaceDotBiz

- Posts

- Interview with Tess Hatch, Partner at Bessemer Venture Partners

Interview with Tess Hatch, Partner at Bessemer Venture Partners

This week I’m sharing a Q&A with Tess Hatch, who is a Partner at Bessemer Venture Partners. Bessemer is a top-tier venture capital fund and was an early investor in two space companies that went public last year, Rocket Lab and Spire Global. At Bessemer, Tess focuses on frontier technology, specifically the commercialization of space, drones, autonomous vehicles, and agriculture and food technology.

I have been fortunate to know Tess for a number of years, having met when we overlapped in the Aeronautics and Astronautics program at Stanford. Tess is an incredibly impressive investor and individual.

You started your career as an engineer in the space industry, first at Boeing and SpaceX, before becoming a venture capital investor. What drew you to space in the first place and then what led to becoming a space investor?

Sally Ride, the first American female astronaut, who went to my childhood school when she was a young girl, came back and spoke when I was attending the school years later. Seeing this brilliant badass lady talk on stage inspired me to follow in her footsteps and aspire to be an astronaut. That started with getting degrees in the field – I got an undergrad and master’s in aerospace engineering – and worked at various space companies. During grad school, I discovered venture capital, which is what I do now, investing in space, deep tech founders, and companies turning theory into reality and pushing the industry forward.

You published an article back in 2018 called Space is Open for Business about the evolving commercial ecosystem in the space industry. Since that article was released in 2018, what developments in the space industry have emerged in line with your expectations, and what developments have surprised you?

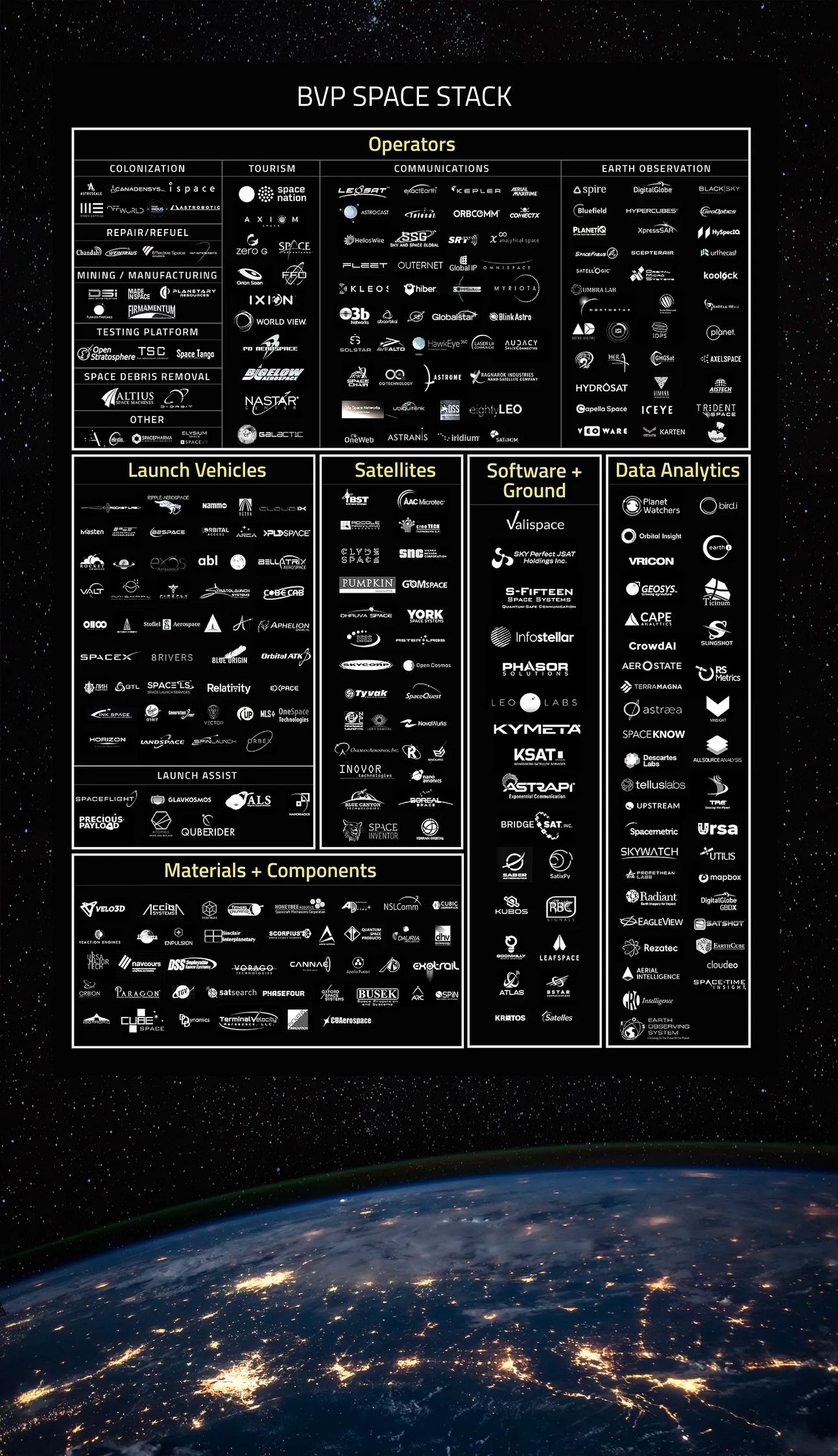

The biggest surprise is how relevant the article still appears to be today. Some of the companies have “graduated” and moved off the ecosystem graphic (which are private companies) to public companies.

The graphic that Tess is referring to in the above statement. Source: https://medium.com/@BessemerVP/space-is-open-for-business-7af18ad0fc20

Indeed, a dozen space companies went public last year via a SPAC. I don’t think anyone would have expected that back in 2018. On the other hand, as expected, we are seeing vertical integration in the industry, specifically between rocket and satellite companies. The two most prominent examples are SpaceX + Starlink and Rocket Lab + Photon. SpaceX has acquired Swarm and Rocket Lab has acquired Sinclair, Advanced Solutions, Planetary Systems, and SolAero.

What is something that you wish more entrepreneurs knew when they start reaching out to early-stage investors about raising funding?

It’s a relationship/conversation! I encourage all entrepreneurs to do as much diligence on the investor as the investor does on the company. Call up every CEO/founder the investor has worked with and ask them about working with the investor. Emphasis needs to be on the person, and not just the firm. You are about to partner with this person for the foreseeable future so make sure you two are the right match.

You’ve served previously as a board director at Spire Global and currently as a board observer at Rocket Lab; two space companies that reached public markets in the past year through SPAC’s. What has it been like in seeing early-stage space companies transition into mature public entities?

Rocket Lab and Spire have a lot in common - unique and proven tech, revenue hyper-growth, space-savvy investors, and brilliant founders named Pete! Rocket Lab has already launched 23 times into space with its electron rocket lowering the barrier of entry to space by making launch cheaper and more frequent. Now that it is public, it will continue to launch its electron rocket with increasing frequency, as well as build a larger 8-ton rocket called Neutron. Spire Global operates a constellation of satellites to track planes and ships as well as monitor the weather. Now that it is public, it will continue to collect and democratize this data for important applications like preventing illegal fishing and disaster response/prevention. It’s amazing what these companies have achieved with venture backing and I’m delighted for them to continue this journey as public companies.

What are you most excited about for the years ahead in the space industry?

A time when all of us are traveling to space with the frequency in which we currently travel in an aircraft.

What do you think people aren’t paying enough attention to in the space industry?

That space exploration helps life here on earth. I fundamentally believe we need to be a multi-planet species in order to survive – and this isn’t to give up here on Earth, but because the technology needed to get to and sustain life elsewhere will help fix the problems we currently face here. For example, the list of technologies that have resulted from space exploration, from MRI/CT Scanning technology to implantable heart monitors to water purification systems to laser eye surgery, is endless. I’m confident when we go back to the moon and beyond, more incredibly important technologies that help us here on Earth will be added to that list.

Before we wrap up, I want to share information on an organization that Tess supports, the Brooke Owens Fellowship. The Brooke Owens Fellowship Program offers paid internships and executive mentorship for exceptional undergraduate women and gender-minority students in aerospace. It is an incredible program that offers students the opportunity to connect directly with the leaders in aerospace and Tess serves as a mentor for the program. You can check out the Brooke Owens Fellowship Program website here.

Liked This Read?

Please share with friends:

If you don’t already subscribe to SpaceDotBiz, you can do so here:

And if you want more insights from space leaders, check out this previous interview with Aerospace Corporation CEO Steve Isakowitz.

Reply